At the end of the period (usually a month), a Total Payment row will be added to the Cash Payment Journal, showing the total amount for each column. The accountants use data in this journal to make a posting in General Ledger and the subsidiary ledgers. When it comes to recording cash disbursements, be as specific as possible. Don’t just include the amount of money you spent on the transaction. A cash disbursement is a payment that a business makes with cash or a cash equivalent.

Trial Balance

These are the easiest to obtain and maintain and are most common, especially for small business owners. At the end of the month, reconcile your accounts payable ledgers with the accounts payable control account. The control account is the total accounts payable balance from cash disbursement journal example your general ledger. The beginning accounts payable total, plus purchases on account during the month, minus payments on account during the month, should equal the ending accounts payable total. Compare this amount to the sum of the individual accounts payable ledgers.

Bank runs in the age of interconnectivity: Lessons for internal auditors

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

- Create and update a cash disbursement journal whenever you purchase something with cash or a cash equivalent.

- Although it would be preferable if all disbursements were made by check and all receipts were deposited intact, most firms usually maintain a small amount of cash on hand for miscellaneous expenditures.

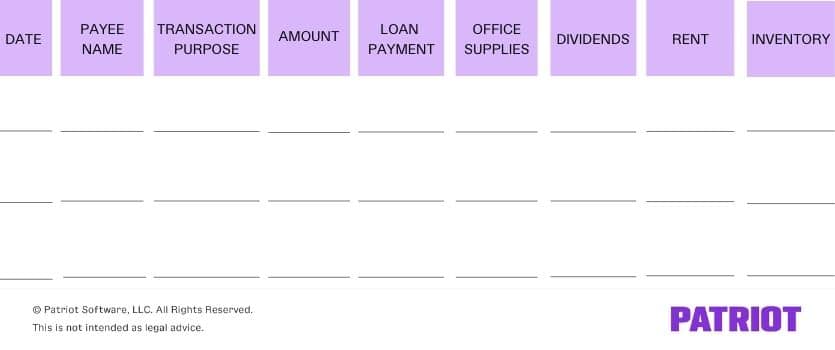

- Record all details for all journal entries in the cash disbursements journal, such as the payee’s name, the purpose of payment, and any additional notes or comments.

- There are several types of cash books that entities can use, whether they’re businesses or individuals.

How does a company process petty cash reimbursements?

A cash book serves the purpose of both the journal and ledger, whereas a cash account is structured like a ledger. Details or narration about the source or use of funds are required in a cash book but not in a cash account. When you mail statements to your customers every month, you should reconcile your accounts receivable ledgers with the accounts receivable control account.

Forensic Accounting: Definition, History & Methods

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

The Accounts Payable section is used to record the amount for which the supplier’s account is debited. Regardless of the type of company, a business owner needs to use a cash disbursement journal any time cash is disbursed to keep a record of where money is being spent. It is a critical tool in the success of any business as well as making sure all information provided to the Internal Revenue Service (IRS) is correct at tax time. Consider the following example for a better understanding of how entries in a cash disbursement journal are made and how the posting to accounts payable subsidiary ledger and general ledger is performed. Small payments are often needed for postage, delivery charges, office supplies, or entertainment expenses. A petty cash fund provides an efficient way of handling these payments.

This also means that you estimate the useful life of your asset, e.g., five years. Over that period, you have to save some of your earnings to buy another one when it can no longer be used like before. This portion of the income you save is an expense for the current period. Only one person should have access to the petty cash, so that one person is held accountable for it. Cash disbursement refers to the distribution of cash from a company’s funds or cash reserves to meet its financial obligations. At the end of the month (or another period), we can then sum these up.

It uses a computer program fully designed by in-house programmers of the business or accounting software that is readily available in the market. After that, you print the entries you have made, bind them, and present them to the BIR for registration. Accounts receivable can be a little fun—after all, it’s all about raking in your hard-earned dough. Accounts payable (often called A/P), on the other hand, focuses on the unpaid bills of the business—that is, the money you owe your suppliers and other creditors. The sum of the amounts you owe to your suppliers is listed as a current liability on your balance sheet. Accounts receivable (often abbreviated A/R) are simply unpaid customer invoices and any other money owed to you by your customers.